Opportunity: Analysts predict Ethereum massive run beyond $4,000 soon

Ethereum (ETH) has experienced a significant decline of around 6.60% over the past week, hitting lows near $3,100 following the launch of Ethereum spot ETFs.

Despite this recent turbulence, market analysts remain optimistic about Ethereum’s potential for a substantial upward surge. Key metrics and technical patterns suggest that Ethereum is gearing up for a major rally, potentially driving its price beyond the $4,000 mark.

In a TradingView post on July 27, analyst RLinda highlighted that the ETHUSDT chart shows bulls actively maintaining the price above a crucial support line.

Picks for you

According to the Analysis, Ethereum is currently navigating a correction phase, testing crucial zones of interest, specifically the 0.5 Fibonacci retracement level and the 200-day moving average (MA-200).

This correction phase Features a false breakdown, a pattern often leading to significant upward movements supported by strong underlying fundamentals.

Fundamental analysis

The fundamental outlook for Ethereum is notably positive. The recent launch of Ethereum ETFs on July 23 has been gaining traction, contributing to a bullish sentiment in the market.

The observed correction over the past two days is primarily attributed to outflows from Grayscale, a pattern previously seen with Bitcoin (BTC).

According to data from SoSo Value, July 26 was a particularly volatile day for spot Ether ETFs, with net outflows totaling $163 million. Despite these outflows, the overall sentiment for Ethereum remains bullish, underpinned by strong fundamentals and favorable market conditions.

Market dynamics

Additionally, minor pressures from the ongoing Mt.Gox situation are counterbalanced by the strengthening of Bitcoin. BTC transfers to exchanges and their distribution among debtors indicate solid market support, which indirectly benefits Ethereum.

This behavior of Bitcoin, the flagship cryptocurrency, shows a supportive environment for Ethereum’s price action.

Key technical indicators

From a technical perspective, Ethereum is forming a correction to the 0.5 Fibonacci retracement level relative to its preceding bullish momentum. This is complemented by a retest of the daily MA-200.

The occurrence of a false breakdown and subsequent aggressive buyback signals the presence of a strong buyer base, unwilling to let the price fall below the critical $3,000 mark.

Key resistance levels to monitor are $3,357 and $3,540. Should the price break through these resistance levels, it could pave the way for a robust rally towards the $4,000 psychological level.

Beyond $4,000, the next significant resistance targets are $4,500 and $4,900.Support levels are critically positioned around $3,200 and the MA-200.

The primary objective for Ethereum bulls is to sustain the defense above the $3,200 zone of interest. Maintaining this support level is crucial for setting the stage for a potential upward breakout.

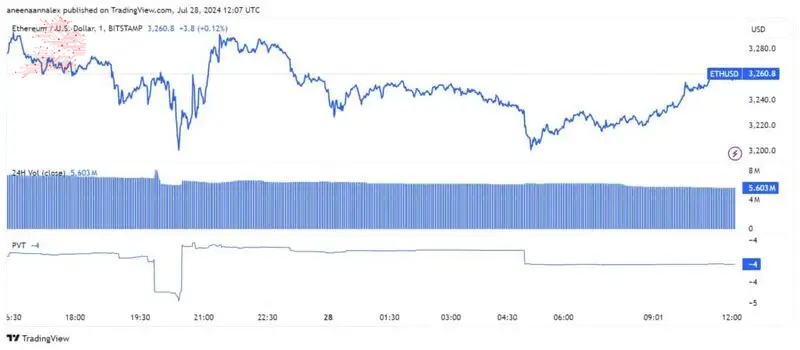

Ethereum price analysis

As of the latest update, Ethereum is trading at $3,249, reflecting a 0.66% decrease on the daily chart.

The combination of strong technical signals and supportive fundamentals, despite recent ETF outflows, indicates a high probability of Ethereum reaching and surpassing the $4,000 mark, potentially targeting $4,500 and beyond.

Investors should watch for sustained support above $3,200 and a breakthrough of key resistance levels to confirm the next bullish phase.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment