Will Germany’s 900 BTC dump tank Bitcoin below $60,000?

The German government has resumed liquidating its seized Bitcoin (BTC) assets, sparking concerns about further price declines in the cryptocurrency market.

Recently, a cryptocurrency wallet labeled “German Government (BKA)” transferred 400 BTC, worth about $25 million, to cryptocurrency exchanges Coinbase (NASDAQ: COIN) and Kraken. Additionally, 500 BTC (over $30 million worth) was moved to an unknown address, a wallet labeled “139Po,” according to Arkham Intelligence.

Notably, this isn’t the first interaction between the German government and the “139Po” wallet. Previous transactions include 800 BTC sent on June 20 and 500 BTC on June 19.

Picks for you

Despite these sales, the wallet still holds 46,359 BTC, valued at approximately $2.8 billion.

These Bitcoin assets were initially seized from the movie piracy website Movie2k.to in January 2020, marking the largest Bitcoin seizure by German law enforcement.

Last week, the government sold around $325 million worth of Bitcoin, indicating a significant step in liquidating their holdings, with potential for further sales on the horizon.

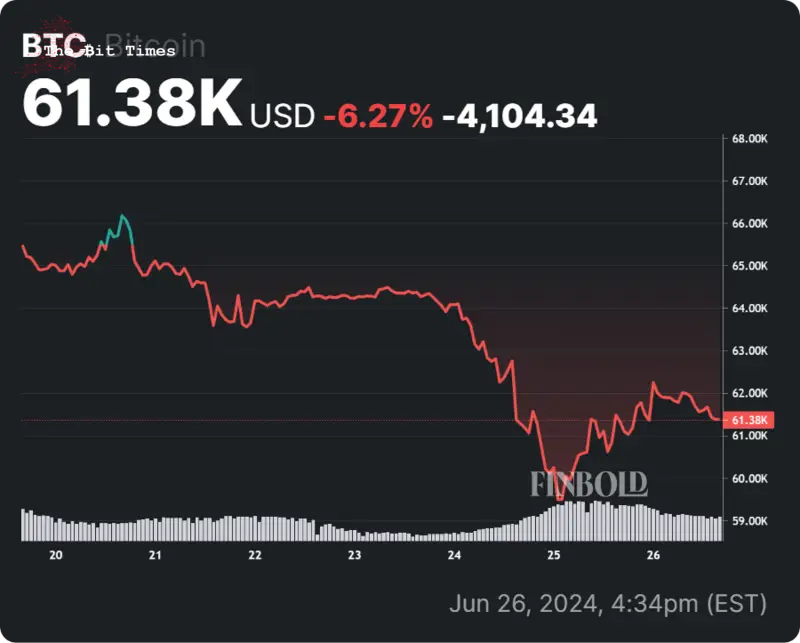

Significant sell-off pressure could push Bitcoin below $60,000

The government-labeled wallet holds over $2.8 billion worth of BTC and could introduce significant selling pressure that might push Bitcoin’s price below the key $60,000 psychological mark.

Furthermore, the recent sell-offs have coincided with a bearish trend in the cryptocurrency market. The timing of the sell-offs, combined with other market pressures such as large outflows from Bitcoin spot exchange-traded funds (ETFs), has exacerbated the price declines.

At present, Bitcoin is changing hands at $61,391, with a modest gain of 0.06% in the last 24 hours, adding to an accumulated loss of 10% on its monthly chart.

Looking ahead, additional selling pressure could emerge in July as the defunct cryptocurrency exchange Mt. Gox plans to repay its creditors. With over $9.4 billion worth of Bitcoin owed to approximately 127,000 creditors, the market could face further downward pressure. This potential influx of Bitcoin onto the market adds another layer of uncertainty.

Furthermore, the cryptocurrency market has experienced heightened volatility, with liquidations topping $300 million on Monday.

Bitcoin accounted for roughly half of these liquidations, around $150 million, while Ethereum (ETH) saw $66 million in liquidations. These recent market movements have primarily affected long positions, leading to forced closures and further price pressure.

Despite the recent dip, the German government’s current holdings of 46,359 BTC, worth $2.8 billion, continue to pose a significant risk of additional market fluctuations. As the situation develops, investors will be closely monitoring the government’s actions and the broader market’s response to these substantial Bitcoin liquidations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment