Here’s why XRP price is crashing

XRP continues to remain in familiar territory, trading in the red zone as the token encounters further losses.

Notably, XRP is a subject of ongoing speculation, having failed to rally and instead consolidating below the $1 mark. Part of the token’s woes can be attributed to the ongoing Ripple and Securities Exchange Commission (SEC) case.

Part of XRP’s downturn is attributed to the overall market sentiment that has impacted assets such as Bitcoin (BTC). The token needs a significant shift in its price action to avoid further declines, as bears remain in control.

Picks for you

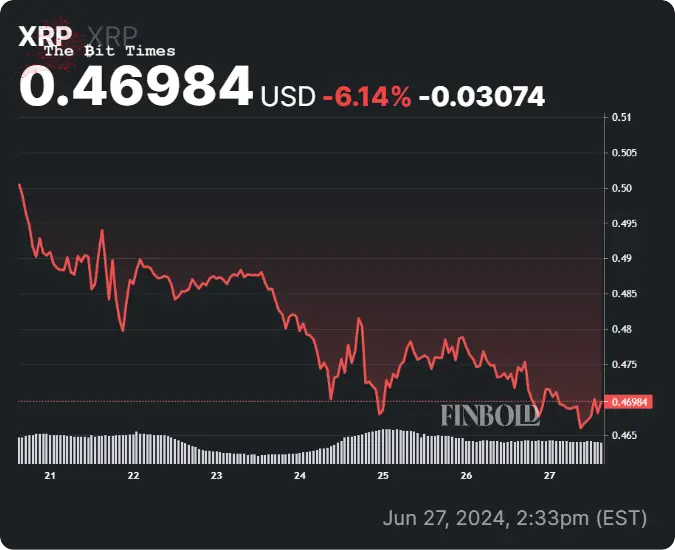

As things stand, XRP has strong support in the $0.45 to $0.46 zone, presenting hope for a rally towards the crucial $0.50 mark. In the meantime, XRP continues to show a sharp decline in the short term.

Why is XRP crashing

Insights into why XRP is plunging can be gathered from on-chain data. Particularly, data shared by crypto Analysis platform Santiment on June 25 hints at what is happening with XRP.

According to the data, investors have realized losses on their token holdings over the past ten days, during which XRP lost the $0.50 support. This is typical of market capitulation, with traders likely selling their tokens at a loss while expecting a further decline in the asset’s price.

Specifically, the XRP Network Realized Profit/Loss (NPL) data indicates negative spikes in the ten-day timeframe, during which losses exceeded $30 million. At the same time, the supply of XRP on exchanges has declined over this period, leading to bearish sentiments.

Additionally, the possibility of further downside from the planned token unlocks is likely causing concern among investors. Notably, as reported by Finbold, XRP plans to unlock 1 billion tokens on July 1, worth $470 million, as part of Ripple’s monthly sell-offs, which could negatively impact the XRP price in the coming weeks.

In the meantime, XRP’s correction has coincided with ongoing regulatory developments. This follows SEC Chair Gary Gensler’s allegations that the crypto sector has harmed the public, comments that have rattled the crypto sector.

For instance, Ripple CEO Brad Garlinghouse criticized Gensler’s statement, terming it “absolute nonsense.”

XRP price analysis

At press time, XRP was trading at $0.46 with daily losses of almost 0.5%. On the weekly chart, the token is down by over 6%.

Overall, XRP’s lifeline depends on breaching the $0.50 resistance zone, which will inspire investor confidence in the asset.

Comments

Post a Comment