Bitcoin whale trader turns bullish, stacks $175 million BTC in May

A Bitcoin (BTC) whale turned bullish in May and recently restarted accumulating coins. The address went from a nearly $20 million worth balance to $175 million this month, holding over 2,600 BTC.

Notably, the Bitcoin Whale address possibly belongs to a cryptocurrency trader, as it shows a high buying and selling activity. Historically, ‘124BPp9mTaXxTXiRx8cxEZDd4sGjoxGk9F‘ received a total of 150,435 BTC and spent 147,831 BTC—consistent trading activity since 2018.

In particular, the whale sold over 2,800 Bitcoin from March to April, holding a remaining 287 BTC bearish balance. However, it started gradually stacking coins on May 3, with its most relevant activity happening in the past 24 hours.

Picks for you

Since May 18, this trader bought 1,590 BTC, adding to an already increasing balance of 1,014 BTC by May 17. Before May, its 287 BTC balance was worth less than $20 million, now sitting in a nearly $175 million stack.

Bitcoin whale activity

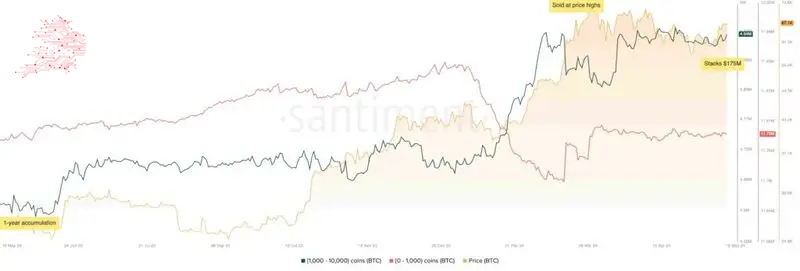

Interestingly, the overall Bitcoin whale activity has signaled a bullish year-over-year price action for BTC, aligning with this trader’s accumulation. Vini Barbosa retrieved data from Santiment’s SanBase Pro for Finbold, showing this aforementioned activity.

As observed, Bitcoin addresses holding from 1,000 to 10,000 BTC have aggressively accumulated nearly 5 million coins. It is worth noting the cross-over of addresses with less than 1,000 BTC a few months before Bitcoin reached new all-time highs: Whales accumulated more, while retail was selling aggressively.

Specifically, the Bitcoin whale trader ‘124BPp9mTaXxTXiRx8cxEZDd4sGjoxGk9F’ sold most of its one-year accumulation at the top and has started accumulating again.

In closing, this recent Bitcoin whale activity could be seen as a bullish signal for the leading cryptocurrency. The address in question has shown a solid history of making good trading decisions and has already stacked $175 million. Should this signal play out, BTC could be heading toward $72,000 and beyond.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk

Comments

Post a Comment