Litecoin Halving Might Trigger A Sell-off; On-Chain Data

Also Read: “X” Token Surges 2000% Post Elon Musk’s Twitter Profile Update

Litecoin Price Dump Ahead?

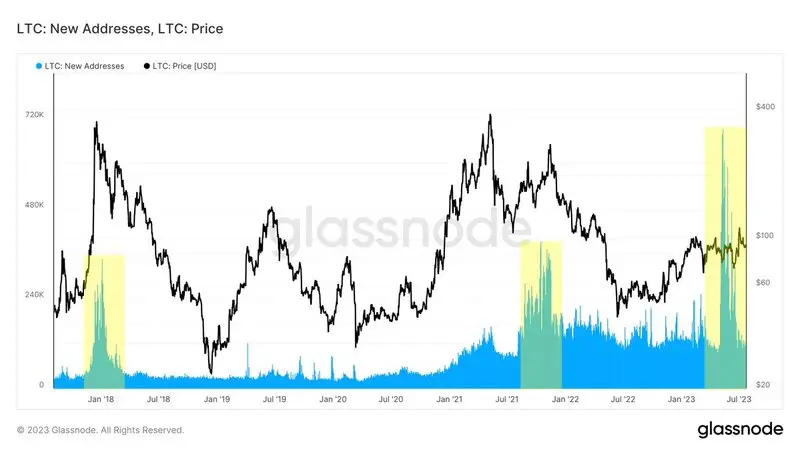

According to Ali, the crypto analyst suggested that wallet addresses for Litecoin have increased dramatically recently. This can prove to be a not good sign for the LTC price ahead as it could face a dump ahead. However, Litecoin’s block subsidy is expected to drop from 12.5 LTC to 6.25 LTC per block after its fourth halving event.

As per the data, every time when LTC addresses exceeded 350K in the past 5 years, a major price correction came in with it. August 2021 to January 2022 was the last period when Litecoin faced this kind of situation.

Ali highlighted that more than 690K LTC addresses have been created recently in the excitement of the halving event which will take place in the next 9 days. He indicated that the upcoming halving could prove to be a selling event. This could lead to increased selling pressure and contribute to short-term price fluctuations.

Sanitment’s data depicts that around 36,800 wallet addresses hold at least 100 Litecoin each. Around 1,185 wallet addresses holding more than 100 LTC, each recently joined this tally.

Litecoin has failed to impress in recent times as its price has just surged by 5% and 0.29% in the last 60 and 90 days, respectively. However, LTC price is down by over 3% in the last 24 hours. It’s trading at an average price of $89.49, at the press time. Litecoin’s 24 trading volume is up by 30% to stand at $482 million.

Comments

Post a Comment